BENEFITS OF MAKING THE SWITCH...

If you want to save money each and every month, switching to energy-efficient windows in your home is the move for you. Single pane windows just can't beat the energy performance of quality double pane energy-efficient windows. The Department of Energy estimates that you can save $125 to $465 dollars a year just from replacing your windows with new Energy Star windows. The significant money you'll save on utility costs or just the undeniable greater quality that these windows will bring to your home is why initiating this switch is ideal.

What is the difference between regular windows and energy-efficient ones?

Yes, regular windows do get the job done, however, there are many pros to consider when deciding whether to make the switch and move to energy-efficient windows. Think about the constant utility bills associated with having to replace your ordinary outdated windows because of constant leaking or loss of warmth. Energy-efficient windows are specifically made to benefit the environment by reducing greenhouse gas emissions, and also the homeowner by providing them with a high-quality product.

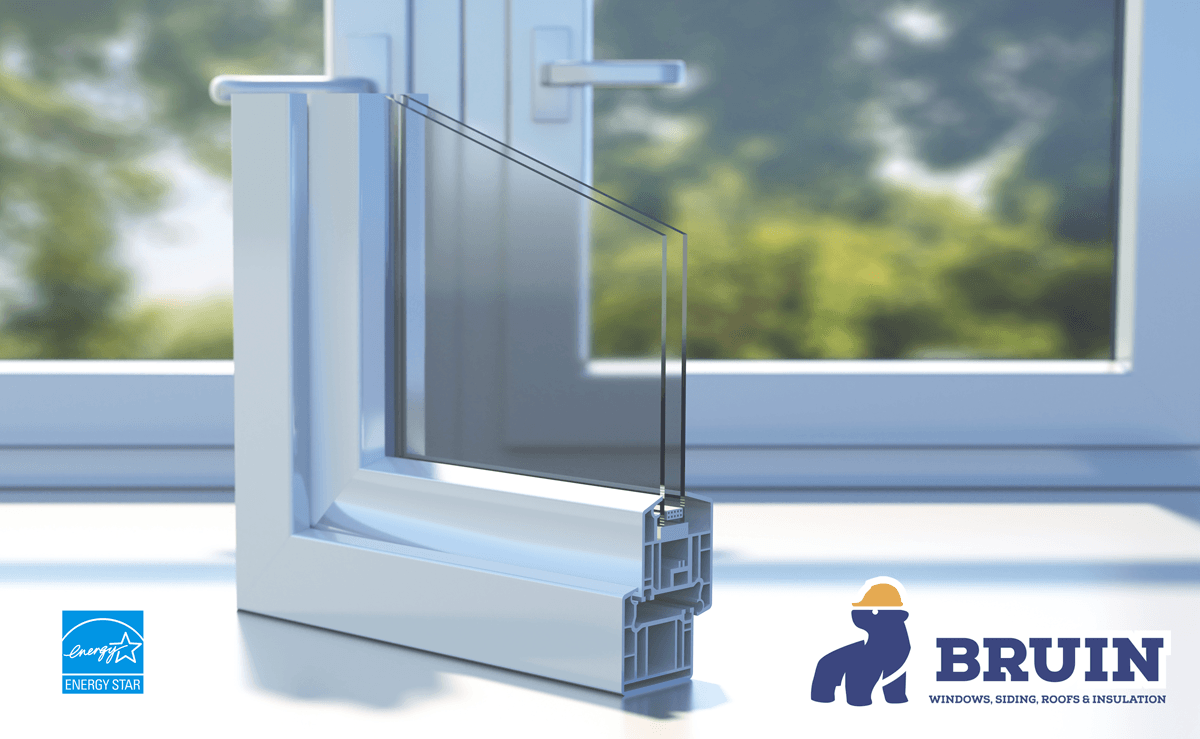

Energy-efficient windows consist of two or more panes of special glass treated with a metallic coating which is used to reflect out more than half of the sun’s harmful UV rays allowing 100% of the natural light to shine through. Between these two panes, traps a layer of inert gas which acts as a blanket between both sheets of glass, preventing any indoor warmth to escape.

Saving Money?

Purchasing and installing energy-efficient windows may be expensive, but it is guaranteed that you will save money in the long run. You will no longer need to pay those bothersome utility costs and could receive a major tax credit from the government.

Tax Credit?

Bruin Corp is an authorized partner for the Mass Save® Home Energy Services Program. Under this program, Massachusetts homeowners qualify for incentives and rebates on energy-efficient updates to their homes. These tax credits are known as Nonbusiness Energy Property Credits, enacted to help balance the cost of home improvements designed to reduce a household's overall carbon footprint.

At Bruin Corp, we understand and follow the requirements set by the Department of Energy regarding materials used in the installation process, which will help you qualify for these tax credits.

FOLLOW THESE GUIDELINES TO RECEIVE YOUR RESIDENTIAL ENERGY TAX CREDITS:

- Save Your Receipts and the Manufacturer's Certification Statement.

- Submit IRS Tax Form 5695 with your taxes.

- Learn more about the qualification criteria at www.irs.gov, and/or consult a tax advisor.

We partner with the best energy efficient window manufactures in the Massachusetts

At Bruin Corp. we will help you make the right window choices for your house and budget. Contact us today for a free consultation.

Connect with our home improvement team