Incredible incentives to update your home

Homeowners who purchase replacement renewable energy products from Bruin Corp. of Framingham could qualify for tax credits that have been extended through December 31, 2021.

These tax credits are known as Nonbusiness Energy Property Credit and were enacted to help offset the cost of home improvements designed to reduce a household's overall carbon footprint.

What Qualifies?

To qualify for the energy credit for windows, the materials and equipment used for the upgrade must meet the requirements and standards set forth by the Department of Energy.

Bruin Corp. of Framingham

knows these standards and will be able to help you choose qualifying items for your next install. Your upgrades will also have to be determined to be a qualified energy efficiency improvement, but you do not have to replace all the windows/doors/skylights in your home to qualify. Your window and skylight upgrades must however be ENERGY STAR certified.

How to Claim Your Tax Credits?

Tax credits for replacement windows and skylights provide an incredible incentive to update your home, improve your energy efficiency and improve your home's overall aesthetics. Please contact a tax professional if you have previously claimed an energy efficiency tax credit or visit www.irs.gov to find out your eligibility for this credit.

Follow these guidelines to receive your residential energy tax credits:

- Current tax credit may be applied to windows and skylights installed between January 1, 2018 to December 31, 2021.

- Save Your Receipts and the Manufacturer's Certification Statement.

- Submit IRS Tax Form 5695 with your taxes.

- Learn more about the qualification criteria at

www.irs.gov, and/or consult a tax advisor.

Limitations

- Must be ENERGY STAR certified.

- Tax credit is for the cost of the product only. The credit does not include installation costs.

- Tax credit is 10% of the amount paid up to the maximums listed below.

- $500 total maximum lifetime tax credit for any and all improvements, including other eligible items as listed in the Section 25C of the Internal Revenue Code:

- $200 total maximum tax credit for qualifying windows and skylights

- $500 total maximum tax credit for all qualifying improvements, including windows or skylights

4. If a combination of windows and skylights are purchased, then the total maximum credit is $500, of which $200 is the maximum allowable for windows and skylights.

5. The tax credit is an extension of the 26 U.S.C. §25C tax credit, which means all previous federal tax credits are a lifetime maximum credit. A homeowner who has already claimed the maximum applicable tax credits permitted under 26 U.S.C. §25C in previous tax years is no longer eligible for this tax credit.

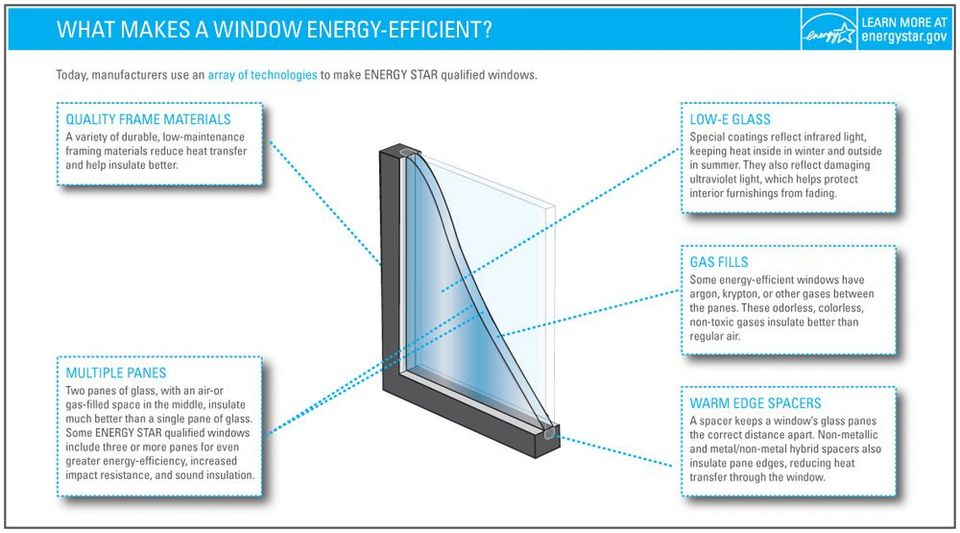

Learn More about ENERGY STAR

- Find more information at www.energystar.gov or call (888) STAR-YES/ (855-385-6599)

- Visit

ENERGY STAR

to determine your ENERGY STAR Climate Zone

Bruin Corp. of Framingham will be able to help you choose qualifying items for your next install.

Connect with our home improvement team